NRF Monthly Report – June 2020 – (File Size – 19.92 KB) Download

NRF Monthly Report – May 2020

NRF Monthly Report – May 2020 – (File Size – 19.92 KB) Download

NRF Monthly Report – April 2020

NRF Monthly Report – April 2020 – (File Size – 19.92 KB) Download

NRF Monthly Report – March 2020

NRF Monthly Report – March 2020 – (File Size – 19.92 KB) Download

Senior Finance Minister says Scotiabank’s announcement of sale of operations premature and inappropriate

Notes that regulatory process yet to be initiated

Georgetown, Ministry of Finance, March 3, 2021:

In reference to the Press Release sent to the media today by Scotiabank announcing that it had reached an agreement for the sale of its banking operations in Guyana to Regional Bank First Citizens Bank Limited, Senior Minister in the Office of the President with Responsibility for Finance, Dr. Ashni Singh said that the announcement is both premature and inappropriate at this time especially since the regulatory process had not been initiated much less concluded.

“It has been just been brought to my notice that a press release was issued .. announcing a sale of the operations of Scotiabank Guyana to a Regional Bank -a Trinidadian Bank in particular. I wish to say that the Government of Guyana considers it extremely unfortunate that this transaction was announced- bearing in mind that any such transaction is subject to a specified regulatory process. In particular, Section 12 of the Financial Institutions Act stipulates that no financial institution may transfer a whole or a substantial part of its operations in Guyana without the prior approval of the Bank of Guyana,” the Minister said to the media at the Arthur Chung Conference Centre where he had been participating, along with Government and the Opposition, in the examination of Budget 2021 Estimates.

While the bank noted in its Press Release that the transaction supports Scotiabank’s strategic decision to focus on operations across its footprint where it can achieve greater scale and deliver the highest value for customers as well as pointing out that its sale agreement was ‘subject to regulatory approval and customary closing conditions’ Minister Singh stated that ‘Considering that the Laws of Guyana require this process, we consider it premature to announce a transaction of this nature’ adding that it is the intention of the Government of Guyana and Guyana’s financial sector’s regulatory supervisor, the Bank of Guyana, to ensure that the Laws of Guyana are complied with in the fullest and to ensure that appropriate processes of due diligence required under the Laws of

Guyana are initiated and concluded before any such transaction can be proceeded with’.

The Finance Minister reiterated that both Government and the Central Bank remain firmly committed to ensuring the maintenance of a stable, strong vibrant, dynamic and growing financial sector especially during the current period as he reminded that ‘it is important that the financial sector is adequately equipped to meet the needs of our evolving economy which as viewers would know is currently going through dramatic changes’. The Finance Minister further posited that Government’s primary objective remains the preservation of a strong and stable financial sector and one that is dynamic and competitive and that can meet the needs of Guyana’s economy.

Minister Singh also emphasised that Government’s paramount concern is the protection and preservation of the stability of the financial system as a whole and, in particular, safeguarding the interests of depositors and customers of the financial system more broadly.

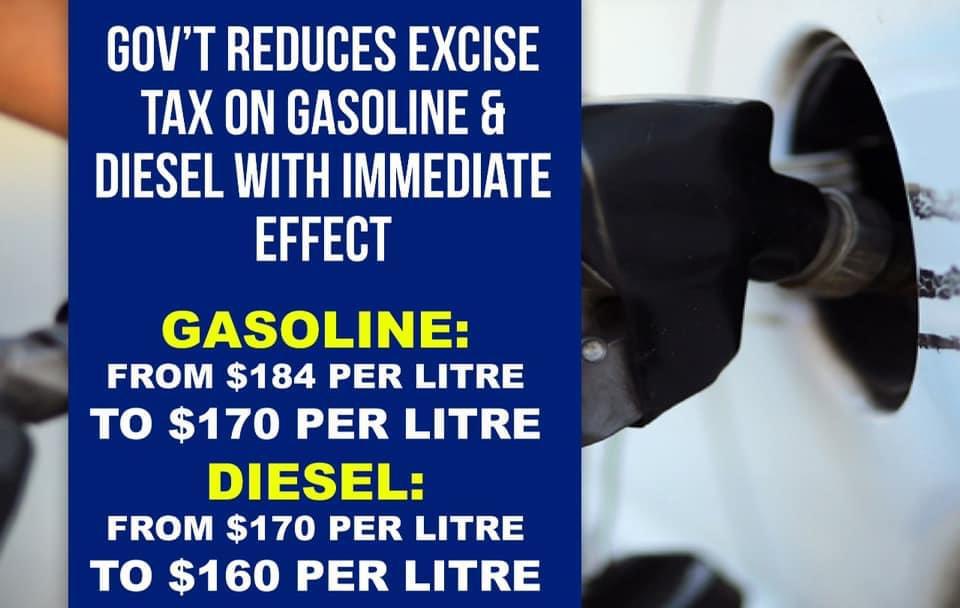

Finance Minister announces cut in Excise Tax on fuel

Prices at Pump to reduce

Georgetown, Ministry of Finance, February 17, 2021:

Senior Minister in the Office of the President with Responsibility for Finance, Dr. Ashni Singh, tonight, announced that Government will be reducing the excise tax on gasoline and diesel to ease the domestic impact of the recent sharp rise in the world market price for fuel.

In announcing the cut in excise taxes, Minister Singh observed that over the past few months, oil prices have risen steadily on the world market, from US$35 a barrel in late October 2020 to over US$60 a barrel at close of trade today. As a result of this steady increase on the world market, fuel prices have also been rising on the domestic market. In order to minimize the impact on domestic consumers, particularly the travelling public as well as those productive sectors for whom fuel is an important input, Minister Singh announced tonight that the Government will be lowering the excise tax rate on both gasoline and diesel from 50 percent to 35 percent with immediate effect.

As a result of the reduction in the excise tax rates, the price at the pump will also be reduced with immediate effect. Specifically, gasoline prices are expected to reduce from $184 per litre to $170 per litre, and diesel prices from $170 per litre to $160 per litre.

Minister Singh explained that, during its previous term in office, the PPP/C Government had put in place arrangements to adjust the excise tax rate on fuel from time to time to cushion the domestic impact of world market price fluctuation, and that the current tax adjustment is being effected using this previously established mechanism.

Minister Singh emphasized that tonight’s adjustments are in keeping with the strong ongoing commitment by President Irfaan Ali’s Government to ensure that domestic customers are protected

from sharp price escalation on the world market and from cost of living increases.

Budget at a Glance 2021

Budget at a Glance – (File Size – 46.2 KB) Download

Budget Estimates 2021 – Volume 3

Budget Estimates 2021 – Volume 3 – (File Size – 19.92 KB) Download

Budget Estimates 2021 – Volume 2

Budget Estimates 2021 – Volume 2 – (File Size – 19.92 KB) Download

Budget Estimates 2021 – Volume 1

Budget Estimates 2021 – Volume 1 – (File Size – 19.92 KB) Download

- « Previous Page

- 1

- …

- 14

- 15

- 16

- 17

- 18

- …

- 27

- Next Page »